philadelphia property tax rate 2022

Look up 2022 sales tax rates for Philadelphia Pennsylvania and surrounding areas. What does this mean for high-tax states like New York New Jersey or Connecticut.

How To Reduce Your Property Tax Bill In Philadelphia

North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina.

. The city of Wilmington has its own income tax. Get a property tax abatement. 15 credit to New Philadelphia residents who work outside the city and pay taxes to other municipalities.

Before you contact CLS please collect materials relating to your case including letters and any recent bills you may have. This is the total of state county and city sales tax rates. This online calculator will help you estimate your new property tax bill for 2023.

Use the Philadelphia Tax Center to file and pay the following taxes electronically. Hamilton County collects on average 153 of a propertys assessed fair market value as property tax. The income tax rate ranges between 0 percent and 66 percent.

The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. 379 for Philadelphia residents. Section 505a and Section 324 describe the proration to property tax reduction allocations and Sterling Act Tax credits that occur when the amount available for distribution is less than 750 million.

1 reduce the real estate tax rate for all properties and 2 reduce the earned income tax rate levied pursuant to section 321. See all posts. Also Delaware has no state sales tax.

Resolve judgements liens and debts. The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. For Tax Year 2021.

Statements of tax policy. Trends and Challenges in the Philadelphia Rental Market June 22 2022. Well it could mean that more people.

The minimum combined 2022 sales tax rate for Philadelphia Pennsylvania is. Electronic funds transfer EFT. If the property appreciated to 620000 when John sells he would pay tax on 20000 at favorable capital gains rate since inherited property.

Property taxes in Delaware are the fourth lowest in the nation. The taxes in Delaware are some of the lowest in the country. North Carolinas median income is 55928 per year so the median yearly property.

Post Stay compliant get your business back on track. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes. Tax management for vacation rental property owners and managers Beverage alcohol.

The state has a progressive income tax. These state taxes include things like. For tax year 2021 you can no longer deduct for state and local taxes in excess of 10000.

Appeal a property assessment. 38398 for Philadelphia. For Tax Year 2022.

BIRT Wage NPT Earnings Liquor SIT Beverage and Tobacco. State and local income tax sales taxes personal property tax and homeowner property taxes. The rate for the city is 125.

Tax details for Philadelphia residents who receive unearned income such as dividends royalties rental income and some types of interest.

Philadelphia Releases New Property Tax Amounts Estimate Your New Tax Bill Here

Did Your Property Taxes Go Up Here S How To Make Your Tax Bill More Affordable

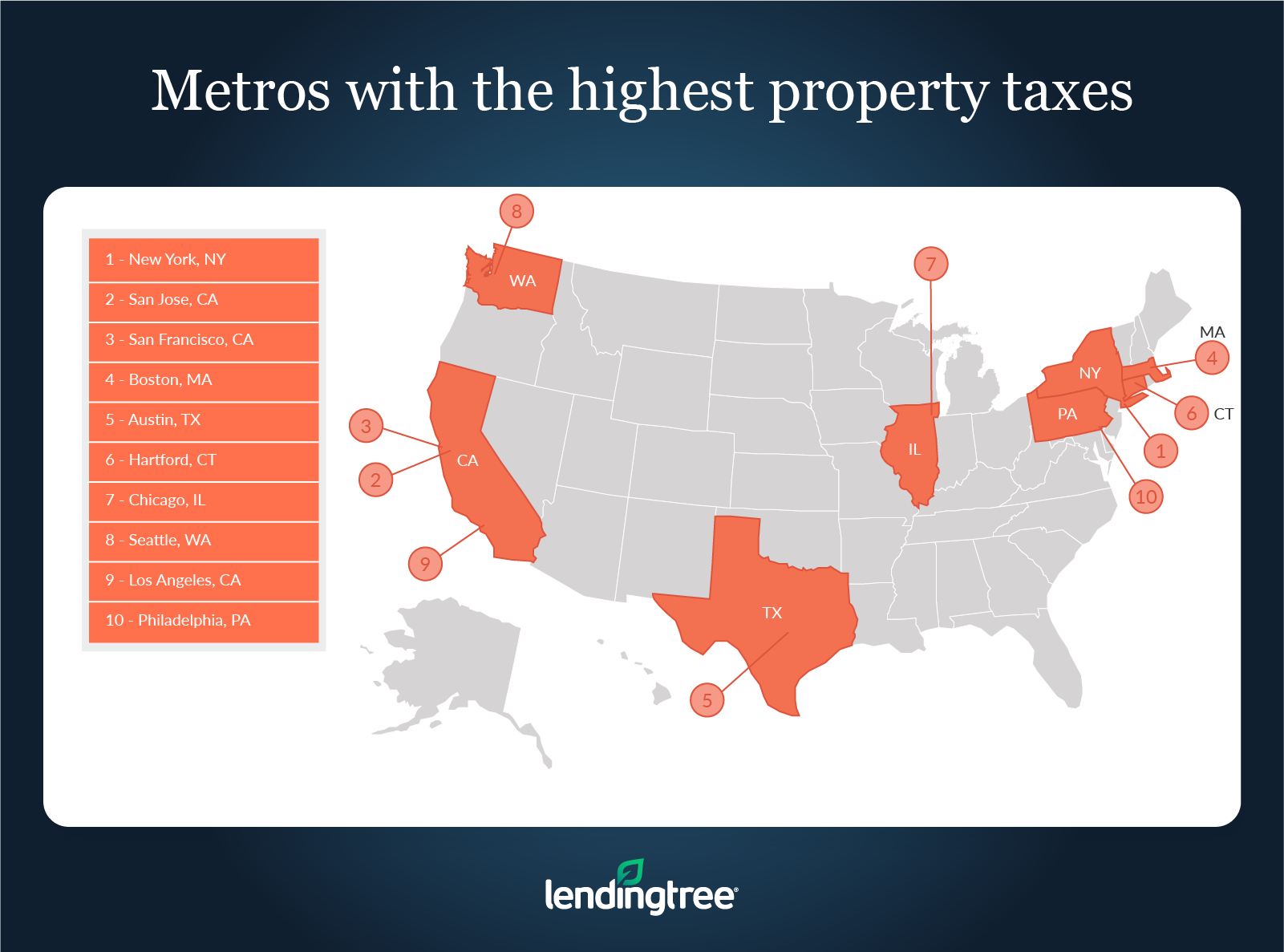

Where People Pay Lowest Highest Property Taxes Lendingtree

Philadelphia County Pa Property Tax Search And Records Propertyshark

Where People Pay Lowest Highest Property Taxes Lendingtree

Airbnb Rental Invoice Template Invoice Template Receipt Template Airbnb Rentals

How Parasites Poison Nyc Suburbs Property Tax System

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Philly City Council Considers Relief For Property Taxes Whyy

/cloudfront-us-east-1.images.arcpublishing.com/pmn/VZQXKD2DQBBDLOVHNFHXVCYERE.jpg)

Where Philadelphia Ranks Among Cities With The Fastest Growing Property Taxes In America

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Philly Property Assessments Double In Some Neighborhoods For 2023 Tax Year

Property Taxes On The Rise South Philly Review

Rehab Homes For Sale In 2022 Apartments For Sale Buying Property Fixer Upper

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal